- TOP

- Investor Relations

- Sustainability

- Governance

- Corporate Governance

Corporate Governance

Corporate Governance Report

Basic Approach

Our basic approach to corporate governance is to thepursue management efficiency to maximize corporatevalue while also reinforcing corporate ethics andincreasing management transparency to increase thetrust we earn from all our stakeholders.

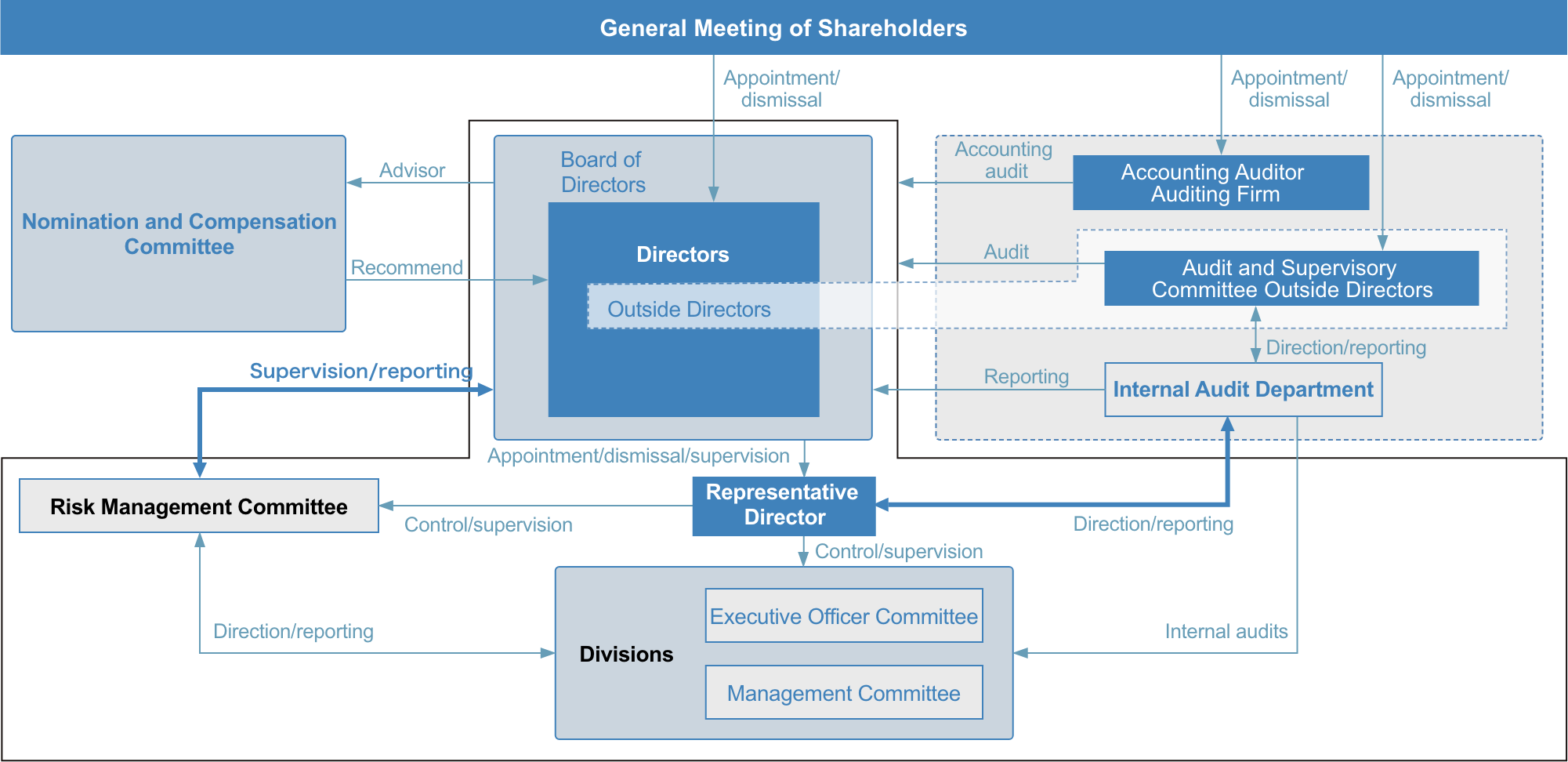

Corporate Governance System

The adoption of this corporate governance structurestrengthens oversight functions by making Audit andSupervisory Committee Members, the peopleresponsible for the audit and oversight of businessexecution by directors, members of the Board ofDirectors. This strengthening of our monitoringfunctions will further enhance corporate governanceand enable the broad consignment of businessexecution tasked to the Board of Directors to variousdirectors. This shift will not only increase the speedof decision-making related to business execution, itwill also allow the Board of Directors to focus ondecisions related to critical management matterssuch as business plans. Overall, this shift willcontribute to improvement in our corporate value.We further enhanced corporate governance byestablishing a Nomination and CompensationCommittee to increase transparency for theevaluation and decision-making processes relatedto director nomination and compensation.

Directors

The Board of Directors is comprised of 8 directors (of which, four are outside directors, including one female).The Board is responsible for making management decisions and monitoring business execution. We strengthen management monitoring functions by appointing outside directors with no interests in the Company. Board of Directors’ meeting are held once per month and impromptu meetings are convened as necessary.

Audit and Supervisory Committee

The Audit and Supervisory Committee consists of three Audit and Supervisory Committee Members, all of whom are Outside Directors. Each Audit and Supervisory Committee Member conducts audits in accordance with the audit policy and audit lan

established by the Audit and Supervisory Committee. For the 2022 fiscal audit year (the Company's audit year is from July to June of the following year), the Audit and Supervisory Committee passed resolutions to determine audit policies, plans, and assignments around the start of the audit year. During the period, the Audit and Supervisory Committee exchanged opinions based on reports from Appointed Audit and Supervisory Committee Members on business activities, including visits to business sites and audits of important approval documents, considered and deliberated on internal control based on reports from the internal auditing division, deliberated on the legality of regular Board of Director meeting proposals, and shared information on risk issues and other matters. For proposals that require information to be shared with Outside Directors, who are not Audit and Supervisory Committee Members, Outside Directors, who are not Audit and Supervisory Committee Members attend as observers and engage in communication. During this business year, one Appointed Audit and Supervisory Committee Member makes visits to each division and subsidiary throughout the year, attends major meetings such as Executive Officer Committee and General Managers' Meeting, and inspects the minutes of important meetings and other important documents. If there are any questions, they receive

explanations from Directors and employees, seeks reports from them, and expresses their opinions. In addition, they attend on-site audits by the accounting auditor, conduct joint audits with the Internal Audit Department, and exchange opinions as appropriate to enhance the effectiveness of audits through mutual cooperation. Part-time Audit and Supervisory Committee Members attend Board of Directors meetings and Audit and Supervisory Committee Member meetings to ask appropriate questions and express their opinions based on their expertise and knowledge as management executives in response to reports and explanations from the Executive directors and Full-time Audit and Supervisory Committee Members.

Furthermore, in FY2023, the Company will not place full-time Audit and Supervisory Committee Members, but will adopt a systematic audit system utilizing the Internal Audit Department and the internal control system. This decision has been

made because the Internal Audit Department has established a system to assist the Audit and Supervisory Committee Members in their duties in the two years since the transition to a company with an Audit and Supervisory Committee, and because the effectiveness of the internal control system has been confirmed, and because the Company judged that it is not particularly necessary to place a fulltime person. However, we have appointed Mr. Suzuki, an Audit and Supervisory Committee Member who served for 10 years until the current business year (including as a full-time Outside Corporate Auditor), as an appointed Audit and Supervisory Committee Member. He will continue to perform important operational auditing duties, such as attending meetings of the Executive Officer Committee, Management Committee, etc., inspecting various important documents, and visiting important business divisions and subsidiaries.

Nomination and Compensation Committee

The Nomination and Compensation Committee has been established as an advisory body to the Board of Directors in order to enhance the fairness, transparency, and objectivity of procedures related to the nomination and remuneration of directors of the Company and to improve corporate governance. The Nomination and Compensation Committee receives inquiries from the Board of Directors, thoroughly discusses matters concerning nomination and compensation, etc., and

reports to the Board of Directors. Furthermore, the Committee is comprised of the President, the Head of Administration Division, and three outside Directors, with the majority being outside Directors.

The skill matrix

Directors who are not Audit and Supervisory Committee Members

| Name | Person in charge | Corporate management, Management strategy | Marketing/ Business development | IT | Logistics/ Purchases | Sales | Oversea | Management personal/ Human resources development | Accounting/ Finance | Legal affairs, Risk | Internal control/ Governance | Experience in different indusries |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Takuji Iuchi | ◎ | 〇 | 〇 | 〇 | 〇 | ◎ | 〇 | 〇 | ||||

| Kazuhito Yamada | Sales Division | ◎ | 〇 | 〇 | ◎ | 〇 | 〇 | 〇 | ||||

| Toshiki Hara | ◎ | 〇 | 〇 | 〇 | ◎ | 〇 | 〇 | 〇 | ||||

| Keisuke Nishikawa | Administration Division |

◎ | ◎ | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||

| Odaki Kazuhiko | ◎ | ◎ | 〇 |

Directors who are Audit and Supervisory Committee Members

| Name | Person in charge | Corporate management, Management strategy | Marketing/ Business development | IT | Logistics/ Purchases | Sales | Oversea | Management personal/ Human resources development | Accounting/ Finance | Legal affairs, Risk | Internal control/ Governance | Experience in different indusries |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Kazutaka Suzuki | 〇 | ◎ | 〇 | 〇 | ◎ | 〇 | ||||||

| Hideaki Mihara | ◎ | ◎ | ||||||||||

| Michiko Kanai | 〇 | ◎ | ◎ |

Corporate executive officer

| Name | Person in charge | Corporate management, Management strategy | Marketing/ Business development | IT | Logistics/ Purchases | Sales | Oversea | Management personal/ Human resources development | Accounting/ Finance | Legal affairs, Risk | Internal control/ Governance | Experience in different indusries |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Mitsushige Kimura |

Overseas Business Division |

〇 | ◎ | 〇 | 〇 | ◎ | 〇 | 〇 | 〇 | |||

| Kaneno Toru | Specialized Business Division |

◎ | ◎ | 〇 | ||||||||

| Isamu Hayashi | AS ONE SHANGHAI Corporation |

〇 | ◎ | 〇 | ◎ | 〇 | ||||||

| Masataka Maruhashi | Electric Commerce Business Division |

◎ | 〇 | ◎ | 〇 | |||||||

| Tomohiro Fukuda | DX Development Division |

〇 | ◎ | 〇 | ||||||||

| Jun Machida | Supply Chain Management Division |

〇 | 〇 | ◎ | 〇 |

Outside Directors’ Role and Independence

AS ONE currently appoints five outside directors. All are registered with the Tokyo Stock Exchange as independent outside directors.

| Name | Number of the Company's shares held (100 shares) | Board of Directors Meeting Attendance | Business relationship with AS ONE and other special interests | Main background or concurrent positions |

|---|---|---|---|---|

| *As of the end of May 2024 | *As of the end of March 2024 | |||

| Outside Director Kazuhiko Odaki | 11 | 13/13 | Not applicable | Formerly worked at the Ministry of Economy, Trade and Industry (until March 2012), Professor, Faculty of Economics, Nihon University (current) |

| Outside Director Kazutaka Suzuki | 27 | 13/13 | Not applicable | Formerly worked at Resona Bank, Limited (until June 2013) |

| Outside Director Hideaki Mihara | 14 | 13/13 | Not applicable | Mihara Accounting Firm (current) |

| Outside Director Michiko Kanai | 32 | 13/13 | Not applicable | Member, Oh-EBASHI LPC & PARTNERS (current) |

Kazutaka Suzuki has worked for Resona Bank,Limited, a bank with which AS ONE does business,and 10 years have passed since he retired from thebank.As of FYE 03/2024, the Group’s total loan balanceis 3.6 billion yen, which is 3.7% of total assets andapproximately 27% of total cash and deposits,indicating we have a low debt dependence.Furthermore, loans from the above bank were 1,375million yen, roughly 1.4% of total assets, and loans from the above bank can be sufficiently substitutedvia other means of procurement.Based on the below and AS ONE’s “Reference:Criteria for Determining Independence of OutsideDirectors and Outside Auditors,” it is our judgementthat there are no problems with the independentstatus of Mr. Suzuki as an Outside Director, andthere are no concerns of any conflicts of interest between general shareholders and the Company.

Criteria for Determining Independence of Outside Directors

In order to ensure objectivity and transparency necessary for proper governance of the Company, the Company considers it desirable for our outside directors to have as much independence as possible, and only if none of the following items apply to outside officers of the Company shall the Company consider them to be independent.

1. A person who does not fall under the requirements under the laws and regulations

2. A party to whom the Company or its subsidiaries (the “Group”) is a principal business counterparty (which receives payment from the Group accounting for 2% or more of the annual consolidated net sales of the party in the most recent business year), or the parent company or a significant subsidiary thereof, or when such party is a company, executive director, executive, executive officer or, manager or other employee thereof

3. A party that is a principal business counterparty (except for those under item 4) of the Group (which made payments to the Group accounting for 2% or more of the annual consolidated net sales of the Group in the most recent business year), or the parent company or a significant subsidiary thereof, or when such party is a company, executive director, executive, executive officer or, manager or other employee thereof

4. Director, auditor, accounting advisor, executive, executive officer or, manager or other employee of a financial institution and other large account creditor that is indispensable to the funds procurement of the Group and on which the Group relies to the extent that there is no alternative, or the parent company or a significant subsidiary thereof

5. Consultant, accounting expert such as a certified public accountant, legal expert such as a lawyer, and other expert that has received 10 million yen or more in monies and other property per year in average for the past three years from the Group, in addition to compensation as officer

6. A party that receives a donation or a subsidy from the Group in an amount of 10 million yen or more per year from the Group

7. A major shareholder of the Company (that directly or indirectly holds 10% or more of the total voting rights) or if the major shareholder is a corporation, director, auditor, accounting advisor, executive, commissioner, executive officer or, manager or other employee of the relevant major shareholder or the parent company or a significant subsidiary thereof

8. Financial auditor of the Group or member, partner or employee of tax accounting firm of the Group

9. Director, auditor, accounting advisor, executive or executive officer of a company that accepts directors (irrespective of whether full-time or part-time) from the Group, or the parent company or a subsidiary thereof

10. Relative within the second degree of kinship of a director and auditor of the Group

11. A party that used to fall under any of 2 to 10 of the above in the most recent five years

12. Any other party that may have a conflict of interest with the overall general shareholders of the Company due to circumstances other than the reasons considered in items 2 through 11 above

Officer Compensation

The maximum amount of compensation for directors wasdetermined at the 60th General Meeting of Shareholdersheld in June 2021. The appropriateness of officercompensation is then deliberated by the Nomination andCompensation Committee, which is comprised of a majorityof independent outside directors, before a final decision ismade by the Board of Directors.The types of compensation consist of fixed compensation (cash), earnings-linked compensation (cash bonuses),earnings-linked non-monetary compensation in the form ofa board benefit trust (BBT), and non-monetary share-basedcompensation subject to transfer restrictions (RS).Furthermore, outside directors and directors who are Auditand Supervisory Committee Members receive only fixedcompensation.Compensation limits are as indicated in the following table.

[Payment status for FYE 03/2024]

| Total amount | Monetary compensation | Non-monetary compensation | Number of applicable people | |||

|---|---|---|---|---|---|---|

| Fixed-compensation | Bonus | Board benefit trust | RS | |||

| Directors (excluding outside directors) | 244 | 143 | 101 | 34 | 20 | 5 |

| Audit and Supervisory Committee(excluding Outside direcotrs) | - | - | - | - | - | - |

| Outside Directors | 45 | 40 | ー | ー | ー | 7 |

(Unit:million yen)

Bonuses are based on consolidated operating profit with afinal decision made based on a comprehensive evaluation ofdividends, employee bonus levels, trends among othercompanies, and medium- and long-term results and pastpayouts.The board benefit trust (BBT) allocates points equivalentto stock based on stock benefit regulations outlined by theCompany and condition to the achievement of net sales andoperating profit goals set forth for each fiscal year plan ofthe Medium-Term Management Plan. Furthermore, if theCompany achieves the goals of the Medium-Term Management Plan, PROJECT ONE, directors are allocatedthe initially scheduled points. If the goals of the upgradedPROJECT ONE ver.2.0 are achieved, then additional pointswill be added and allocated in two stages.To promote objectivity and transparency, the Nominationand Compensation Committee are consulted in advance onspecific individual remuneration ratio by type andcompensation amounts, after which the Board of Directorsvotes to consign final decision-making to the President, whogives due respect to the recommendations of theNomination and Compensation Committee.

The performance criteria used in the calculation ofbonuses is operating profit. The performance criteriaand earnings used as the basis for BBT calculationsare as shown in the table to the right.

| Full-year plan when formulating the Medium-Term Management Plan | FYE 03/2023 goal to be established at the beginning of the relevant fiscal year based on the revised Medium-Term Management Plan | The result of consolidated fiscal year | |

|---|---|---|---|

| Net sales | 90,600 | 96,600 | 95,536 |

| Operating profit | 10,180 | 10,330 | 10,435 |

(Unit:million yen)

Dialogue with Stakeholders

As is represented in our Company name, we strive to workas one with our users, dealers, and suppliers towardscreating new value. Our Sales Division, Customer SupportDivision, and Purchasing Divisions take the lead in engagingin daily communication with these stakeholders to promotedaily improvements.The Public and Investor Relations Department works with the Director in charge of the Administration Division and ourPresident to facilitate communication with shareholders andinvestors. During FYE 03/2024, we held meetings with a totalof more than 430 institutional investors. Recently, we areincreasing engagement with ESG investors, which hasenabled us to partake in valuable exchanges of opinion thatwe later reflect in management.